Content Menu

● Introduction

● Overview of the Malaysian market

● Key capabilities to look for in a partner

● Selecting the right partner in Malaysia

● Industry use cases and export dynamics

● Quality assurance and certifications

● Case examples and workflows (illustrative)

● Supply chain resilience and regional opportunities

● Conclusion

● FAQ

>> 1: What distinguishes a good Uno cards manufacturer in Malaysia for OEM/ODM partnerships?

>> 2: Which certifications are commonly required for international UNO card orders?

>> 3: How should a buyer evaluate a supplier's OEM capabilities?

>> 4: What is a typical lead time for a private-label UNO deck order?

>> 5: How can an international buyer protect IP when partnering with a Malaysian Uno cards manufacturer?

● Citations

Introduction

Malaysia hosts a vibrant ecosystem of printing and packaging providers with robust capabilities in producing playing cards for international brands. For overseas buyers seeking reliable Uno cards manufacturers and suppliers, Malaysia offers a mix of established card producers, finishing specialists, and turnkey OEM/ODM partners. This guide outlines the landscape, highlights critical capabilities, and explains how to evaluate potential partners for security, quality, and scale.

Overview of the Malaysian market

- Market players and scope: A range of textile and packaging groups, specialized printing houses, and consumer goods suppliers operate in Malaysia's manufacturing belt. In particular, several facilities focus on playing cards and related gaming products, with capabilities spanning design, plate making, color management, finishing, embossing, lamination, and packaging. This makes Malaysia an attractive sourcing destination for Uno cards manufacturing and supplying needs. [8][9]

- OEM/ODM capabilities: Supplier networks in Malaysia commonly offer full OEM/ODM packages, from original design development to mass production and private-label packaging. Buyers can leverage customization across card stock, finishes, packaging formats, and branding elements to align with regional market requirements and retailer expectations. [5]

- Quality and compliance emphasis: International buyers often require strict adherence to color accuracy, durability, and safety standards. Malaysian manufacturers frequently implement robust QA processes, traceability, and third-party certifications as part of a global supply chain. [10]

Key capabilities to look for in a partner

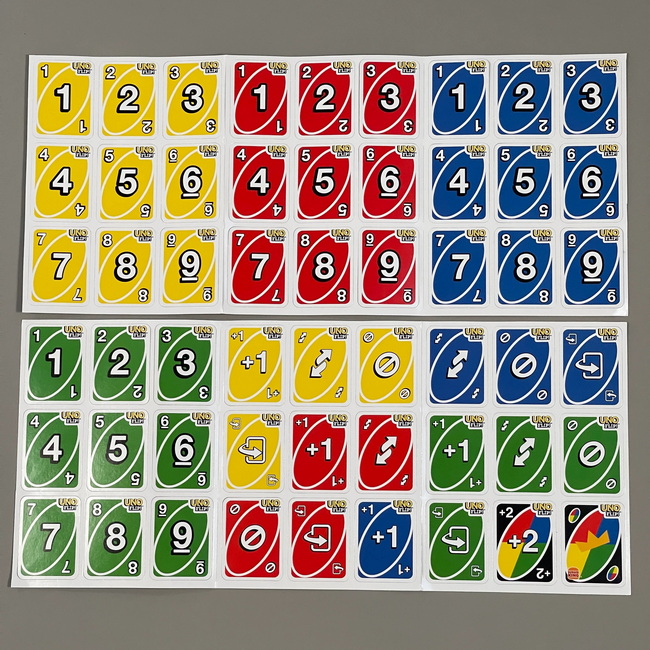

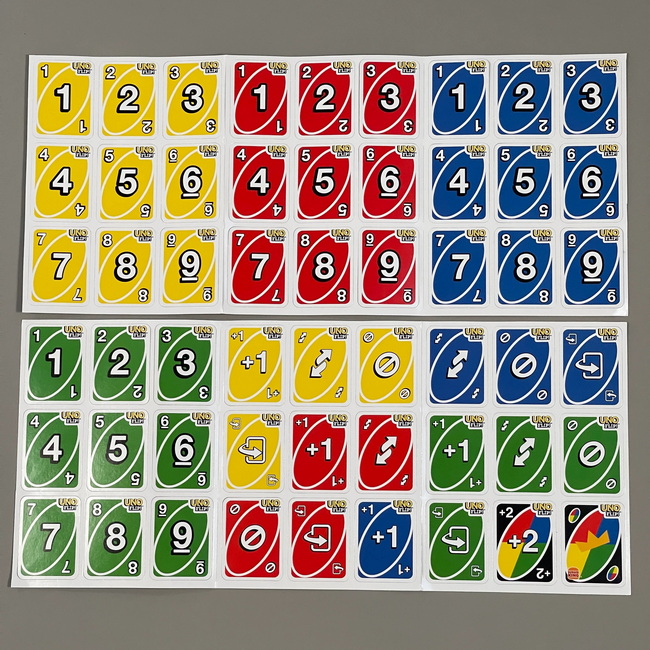

- Card material and construction: The best UNO card suppliers offer multiple card stock options (e.g., 300–400 gsm board with linen or plasticized finishes), precise lamination, and durable embossing or smooth gloss finishes to meet tactile and playability expectations. A credible partner will provide samples and material data sheets to verify stiffness, bend resistance, and wear characteristics.

- Printing and color management: High-quality multi-color printing with consistent ink adhesion, edge-to-edge registration, and reliable back design reproduction are crucial. Look for partners with proofing procedures, ICC color profiles, and on-press quality checks.

- Finishing and embellishments: Embossing, spot foiling, UV coating, and protective lamination can elevate perceived quality and competitiveness in international markets. Suppliers that can bundle these options with packaging customization are particularly valuable for OEM programs.[10]

- Packaging customization: Private-label decks, blister packs, collector editions, and country-specific packaging variations help brands target regional retailers. Choose partners with flexible packaging lines and the ability to print in multiple languages if needed.

- Certification and safety: Buyers should verify compliance with relevant toy and game safety standards in target markets. Reputable manufacturers provide documentation (material safety data, age-appropriateness statements, and compliance certificates) to support regulatory submissions.

- Lead times and scalability: For international buyers, a reliable supplier demonstrates realistic lead times, production capacity planning, and contingency options to manage demand surges. Audit histories or capacity reports are helpful during supplier qualification.

Selecting the right partner in Malaysia

- Due diligence: Start with a short list of 6–10 potential manufacturers or distributors, compare capabilities, and request written quotations, samples, and process flow diagrams. A clear NDA and non-disclosure protections are prudent during early discussions.

- Factory tours and virtual assessments: When possible, conduct on-site audits or virtual factory reviews to observe machinery, production workflow, quality control stations, and packaging lines. This is especially important for OEM/ODM engagements with sensitive branding elements.

- Commercial terms: Clarify IP protection, minimum order quantities, pricing bands, payment terms, and after-sales support. Transparent commercial terms reduce risk for both sides in cross-border transactions.

Industry use cases and export dynamics

- Brand collaboration examples: International toy and game brands often partner with Malaysian manufacturers for private-label Uno decks, custom artwork, and regional packaging variations, enabling faster market entry in Southeast Asia and beyond.[5]

- Logistics considerations: Efficient freight options, packaging protection, and clear labeling facilitate smooth cross-border shipments and reduce damage risk during transit. A partner with established export processes can help streamline distribution to distributors and retailers worldwide.

- Intellectual property and design rights: Working with reputable Malaysian manufacturers typically includes clear IP protection measures, including non-disclosure agreements and agreed-upon licensing terms, which is essential for global brands.

Quality assurance and certifications

- Quality control stages: Card stock evaluation, printing color checks, embossing alignment, lamination integrity tests, and final deck completeness checks are routine in professional manufacturing environments. Documented QC checkpoints should be shared with buyers during supplier qualification.

- Safety and compliance considerations: Ensuring compliance with market-wide safety standards (for example, general toy safety guidelines) is critical for international shipments. Manufacturers should provide certificates and test reports to support compliance.

Case examples and workflows (illustrative)

- OEM workflow: A brand provides artwork and packaging specs; the manufacturer reviews artwork for print-readiness, produces a small pilot run for approval, iterates as needed, and then scales to full production with private-label packaging. This process emphasizes protection of brand identity and efficient production ramp-up.

- Private-label collaboration: A distributor requests a collector-edition deck with bilingual packaging and a specific card back design. The partner coordinates artwork adaptation, color proofs, and a packaging prototype before mass production.

Supply chain resilience and regional opportunities

- Southeast Asia regional access: Malaysia's geographic position supports efficient distribution to Asia-Pacific markets and beyond, facilitating faster delivery timelines for international buyers seeking UNO decks.

- Diversification strategy: Working with multiple suppliers reduces dependency on a single source and provides alternatives for capacity, pricing, and specialized finishes.

Conclusion

For brands seeking Uno cards manufacturers and suppliers with robust OEM/ODM capabilities, Malaysia offers a compelling blend of material flexibility, finishing options, and export-readiness. By carefully evaluating card stock, printing accuracy, finishing and packaging capabilities, and compliance with safety standards, international buyers can establish reliable partnerships that deliver high-quality UNO decks at scale. A thoughtful supplier selection process, including due diligence, media-rich presentations, and clear commercial terms, will help ensure a successful long-term collaboration.

FAQ

1: What distinguishes a good Uno cards manufacturer in Malaysia for OEM/ODM partnerships?

A1: A strong partner offers flexible card stock options, precise color and finish control, comprehensive packaging customization, clear IP protections, and reliable lead times with scalable production capacity.

2: Which certifications are commonly required for international UNO card orders?

A2: Depending on the target market, look for toy safety compliance, material safety datasheets, and relevant regional certificates; reputable manufacturers provide test reports and documentation upon request.

3: How should a buyer evaluate a supplier's OEM capabilities?

A3: Request artwork review, pilot production options, sample decks, production flow diagrams, and a detailed quotation with cost breakdowns and lead times.

4: What is a typical lead time for a private-label UNO deck order?

A4: Lead times vary by quantity and complexity but commonly range from several weeks for samples to several weeks or months for full-scale production, depending on packaging and finishes.

5: How can an international buyer protect IP when partnering with a Malaysian Uno cards manufacturer?

A5: Use written NDAs, clearly defined licensing terms, artwork approval milestones, and contractual provisions that specify ownership and permitted uses of designs.

Citations

[1](https://www.reddit.com/r/unocardgame/comments/1k5fl88/uno_card_country_of_origin/)

[2](https://www.suntree.asia/playing-cards-manufacturing-process/)

[3](https://dalnegro.com/en/production/)

[4](https://www.youtube.com/watch?v=4RbgJvVULws)

[5](https://www.lynk.com.my/index.php?ws=showproducts&products_id=3211893)

[6](https://www.youtube.com/watch?v=GR0NMmvd6QA)

[7](https://www.okadastation.com.my/products/uno-play-card)

[8](https://en.wikipedia.org/wiki/Uno_(card_games))

[9](https://www.wopc.co.uk/explore/keyword/manufacturing-processes/)

[10](https://cartamundi.com/en/production/)